The BDI is a daily survey of demand for shipping of dry goods, which is everything not a liquid (e.g. crude oil primarily), shipped in bulk. All container traffic are measured by an alternate index called HARP. But building materials such as timber or scrap steel, are considered "dry goods" and are a good indicator of economic activity. So, when demand is high for a given supply of ships, the price soars.

This has proven a very good leading indicator for the economy which will show the effect of those material inputs a few months hence. But when demand turns soft and there is less need for shipping to move bulk products around the world, the price drops. Price is very inelastic in respect to demand and the supply of ships takes time to alter. So, for a given short range of time, less than one year, it is hard to find a better indicator of near future economic activity and resultant equity market prices.

The BDI is a daily average of prices to ship raw materials. It represents the cost paid by an end customer to have a shipping company transport raw materials across seas on the Baltic Exchange, the global marketplace for brokering shipping contracts. The index is quoted every working day at 1300 London time. The Baltic canvasses brokers around the world and asks how much it would cost to book various cargoes of raw materials on various routes (e.g. 100,000 tons of iron ore from San Francisco to Hong Kong, or 1,000,000 metric tons of rice from Bangkok to Tokyo).

The index is made up of an average of the Baltic Supramax, Panamax, and Capesize indices. These indices are based on professional assessments made by a panel of international shipbroking companies.

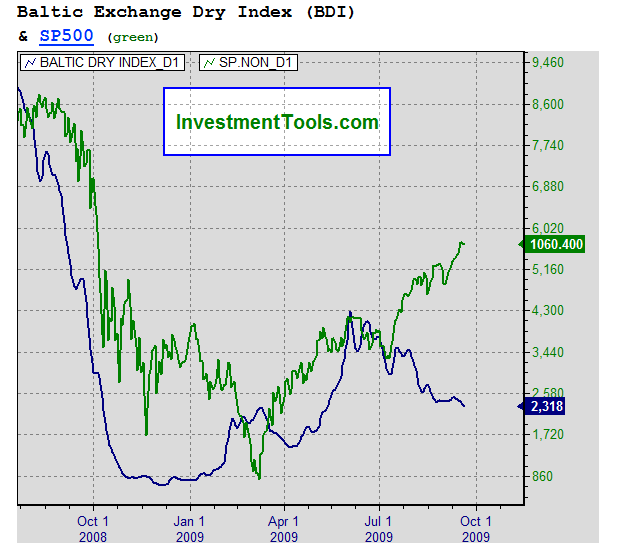

In recent weeks the BDI has staged a substantial correction, leading many confounded as to why things are so. Many believed that the global recovery has started, and that things will still take some time before it gets anywhere to business as usual - even so, the sharp correction in the BDI has some worried. More significantly, those stock markets riding on China leading them out of a recession, may be sitting nervously now - if the mega China stimulus plan is supposed to do what it does, China should be doing a lot of importing, thus the BDI should be well supported, not declining.The chart above is very telling. Many mid-term traders uses the BDI as a major indicator of whether to hold a lot of positions in the stock market or to pare down their holdings. The correlation with the S&P500 has been uncanny but the thing started to diverge since July 2009. That caused a lot of experts to call for a temporary sell on the equity side, and have been kept getting things wrong. When such a divergence happens, and when you plot one variable against the stock market index... 9 out of 10 times, the experts will say that the stock market index is WRONG and the other variable is right. This blatant discrimination lies in the fact that all experts think that the stock markets are generally made up of idiots, momentum traders, retail players who will buy and sell at the wrong time. The same group of experts will accord "more respect" to BDI because its a more localised index and is research and accumulated from real industry players.

So, who is right? Has the stock markets run ahead of themselves? Even if you look at commodity prices in general, they have held up pretty well over the last 2 months, which is even more confounding - if commodity prices are steady with a slight upside bias, why then was the BDI so weak.

This time around, I am siding with the stock index, I think it is more correct than the BDI. The BDI is a highly volatile indicator, and if you look at it, the BDI has risen enormously for the first half of the year. A correction is normal as many industry operators are loathed to bet on a strong recovery in global trade, they'd rather sell their open capacity as and when possible. The divergence is significant because the BDI has fallen more than 40% since June 09, while the S&P500 has gone the other way.

Traders and experts harping on the sanctity and importance of BDI need to go wash their faces every now and then. Just because the BDI was a good indicator does not mean it will always be a good leading indicator for the stock market. Things evolve. The BDI this time around was very much affected by things happening in China, when they announce the stimulus plan, the BDI went ballistic. When China construction slowed over the last 2 months, the BDI started to collapse. The key is understanding what, where and why China is doing what it is showing. You cannot comment on the BDI superficially until you understand the motivations behind those figures.

The highest level the BDI reached this year was 4,291 points on June 3. The index as of yesterday was just 2,357. The BDI may hit 4,000 points before the year is over just be assessing the increasing demand for iron ore and grains from China. Iron ore demand is linked to construction activity, which many international traders saw as weakening over the last 3 months. One has to understand the nature of construction in China. Most construction works were slow in the third quarter owing to hot weather, which is quite common especially in southern China. The recent cold spell should prompt more coal to be exported to China as well. Iron ore is the largest dry-bulk cargo moved by sea and China is a major consumer of the commodity.

Furthermore bumper crop harvesting such as wheat and corn in the United States would also contribute to the rise in the BDI in the coming weeks. Bloomberg reported China Ocean Shipping (Group) Co as saying the BDI might surge more than 80% by the year-end on increased demand from China.

The stimulus plan by China has barely started to kick in but the BDI has staged a magnificent rally since February this year, safe to say here that the BDI has run a bit ahead of the real economy. China has started to turn the taps from its stimulus plan but certainly not all will done in one shot or over just one year, in that sense the BDI may have no reason to join in the rally in the first place with the S&P500, and now is just correcting to the real economy, and not the other way around.

p/s photos: Angelababy Yang Wing

1 comment:

We need to put the graphs in context. In the case of the one procided by Inv Tools, it is flawed beacuse of the period used. If you extend to past 10 years say.

S&P500 is back to where it was in 1998. Lost decade.

Now what was the BDI in 1998? Plot them together and we'll see a better comparison.

Not forget BDI went past 10,000, gain of almost 3X. While S&P stay around 1500. So BDI was inflated like oil prices. Even at current levels, the shippers are making money. So it's ok.

Post a Comment