Thursday, November 29, 2007

Share price of Cominetel Corporation Bhd plunged in early trade on Nov 29, falling 29.66% or 43 sen to RM1.02 on extended heavy selling pressure. It opened at RM1.45 unchanged. At 9.03am, it plunged to RM1.02. Within the first hour, there were 5.77 million shares done at prices ranging from RM1.02 to RM1.49. At 10am, it was trading at RM1.02, the lowest since May 10. There were 1.08 million sellers at RM1.02 but no buyers. Yesterday, the share price hit limit down. Falling 65 sen to RM1.45, wiping out six weeks worth of gains. The company was queried by Bursa Malaysia over the sharp fall in the share price.

The Edge reported this back in June 2007:

Telecommunication solutions provider Comintel Corp Bhd is focusing on securing value-added projects for its manufacturing services and communication and system integration divisions to help address its thin margins and loss-making position. "In a way, we are moving away from our traditional contracts to value-added projects, where margins are better but risks are higher," its managing director Lim Keng Hock tells The Edge.

One such project that the company hopes to secure is the nationwide implementation of the C4i system for the police force, which is worth some RM1.5 billion over five years. The C4i system, developed and patented by Comintel, involves the integration of all base operations for command and control purposes. It provides the police with improved command, control, communication computing and information capability to enhance the force's ability to respond quickly to emergencies.

The rollout of the system's pilot phase was commissioned in 2005 and it has become fully operational in the Klang Valley. According to Lim, the system has improved the force's response to emergencies. The missing link in the overall effectiveness of the system is the "999" number connectivity because Telekom Malaysia Bhd is reluctant to give it up to the police force, he adds. This is despite a government directive in 2005 to route all calls made to the police and ambulance and fire services to police headquarters at Bukit Aman or any other centre set up for the purpose, he says. At present, Telekom operators handle "999" emergency calls, of which about 90% are crank calls. With the C4i system, Lim says, crank calls will drop substantially and the police force will be able to respond and take action swiftly.

Last December, Comintel's subsidiary Comlenia Sdn Bhd was awarded a RM115 million turnkey contract by MiTV Corp Sdn Bhd for the rollout of a new broadcast network and infrastructure over three years. MiTV is migrating its broadcast technology network from the existing video codec standard to the MPEG4/H.264 advanced digital video codec standard.

Also, Comlenia, which provides system integration services, has recurring revenue of about RM20 million annually from the Royal Malaysian Navy for the maintenance and system upgrades of four Corvettes. In terms of manufacturing contracts, Comintel recently secured a three-year deal from Motorola Inc to design, develop and supply various categories of products to the latter. "The new contract with Motorola enables us to participate in the design on portable radio. Also, Comintel is able to command better pricing, with no more discounts given," Lim says. He adds that the company is also looking at value-added contracts in its manufacturing division. "We are developing our own products, such as dual-band phones. From now till 2010, people will be moving into IT phones. In the interim, there is a gap for migration. We plan for mass production of dual-band phones sometime in September. Already, British Telecom, Google and MSN are interested in our products." "We will either manufacture the phone under our own brand or we might brand it for our clients. The intellectual property for this phone belongs to the group," Lim says. He adds that Comintel plans to sell the dual-band phones, which support WiFi (wireless fidelity) and GSM bandwidths, at about US$399 (about RM1,363) each. "We are only commercialising in September, so we are looking to sell between 50,000 and 100,000 phones this year." Lim says based on research, demand for such phones is estimated at 50 million units worldwide next year. "We are going to be the first one to launch the phone. If we can capture 10% of the market, it will be good," he adds. Moving forward, Comintel executive director Loh Hock Chiang says the company is eyeing contracts worth RM500 million to RM1 billion related to IT and telecommunication solutions this year. These contracts, which will provide better margins to the company, will help turn around Comintel for the financial year ending Jan 31, 2008.

"This year, based on what we are looking at now, we should be profitable. We are looking at a 10 sen earnings per share target. We anticipate that the manufacturing division will grow but at the same time, our system integration will more than double. Margins from system integration projects can give the company better margins," Loh says.

In FY2007, Comintel went into the red with a net loss of RM3.03 million from a net profit of RM1.43 million last year. This is despite a higher revenue of RM324.3 million against RM297.9 million in the previous year. "Revenue for FY2007, mainly from the manufacturing division, has gone up while margins are thin. Furthermore, with the appreciation of the ringgit, we convert less from our billings, which is denominated in US dollars," Loh explains.

He adds that losses were incurred due to lower government spending as a result of the Eighth Malaysia Plan being in its tail end and huge investment in research and development.

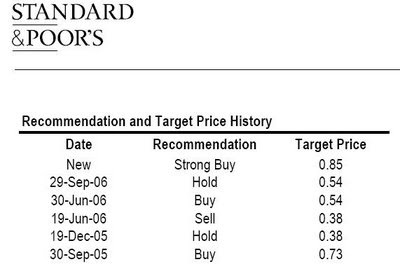

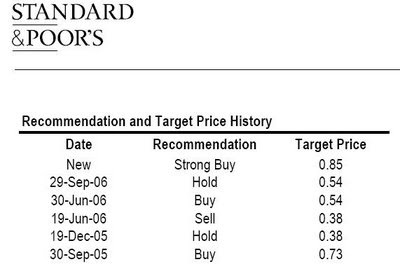

K&N Kenanga has a research report dated October 1st 2007, which recommended a HOLD on the counter. The stock was 92 sen then. The report's recommendation:

Wednesday, November 28, 2007

Best Dim Sum Place

Markets are so boring, no stock to look at, let's talk food. Being Cantonese and all, finding really good dim sum places is really difficult. In fact the better ones can be found, of all places, in Sydney! That's due to the wave of migration from HK in the 90s to Australia. Many good chefs came as part of that wave ahead of 97 then.

When I visit HK, the standard for dim sum is very high indeed. However, my all time favourite dish when eating there was this very simple "see yau wong cheong fun". Its like chue cheong fun here but thicker and its tossed with superior soya, its all in the soya I guess. The simple dish cost HK$30 at the dim sum place in New World Hotel, Kowloon and I always go back there every time I'm in HK.

Back to dim sum in Malaysia. Unfortunately, my favourite place cannot be found in KL, its Ming Court (or Ming Kok in Cantonese when asking for directions driving around in Ipoh). The spread is as in the photo, everything is just very good or unbelievably good. Some of the older diehards will opt for Fohsan as their best place, but I think that's more due to loyalty and longevity reasons. Fair is fair, Ming Kok wins easily. Get the woo-kok, char siew pau, century egg/lean meat porridge, black sesame soup dessert, egg tart and baked siew pau!!!

Tuesday, November 27, 2007

Synergy Drive: Some Caveats

The Malaysian markets will be in for a major fillip on Friday owing to the requotation of sorts via Synergy Drive. Conservative estimates see the KLCI jumping 30-35 points based on the requotation, thus we are looking at 1,400-1,420 as the new base judging by today's market performance.

While many foreign houses and international funds played Sime Darby prior to its suspension. Many opted to cash out rather than hold for the extended suspension period to get Synergy Drive's shares. SD is expected to account for 9% of the recalculated KLCI capitalisation. Regional and index funds will have to have SD in their portfolio, no two ways about it.

There is a prediction that some investors will sell other plantation counters to switch to SD. That is unlikely to hold true as SD is not a pure plantation exposure. While SD will be the biggest in terms of plantation earnings, it is not a pure play - and that could be the thing which could trip up SD.

For FY07, plantations will contribute 45% of SD's operating profit. The figure rises to 52% for FY08. Its a significant figure but it still looks more like a conglomerate to me, and probably to most professional investors. Those bullish on SD have cited its involvement in the Bakun dam and undersea hydroelectric cable and power transmission to the peninsular as the near term catalyst.

The fact that its not pure plantation may actually result in a lower valuation over the longer term. I would expect the initial couple of weeks to see robust uptrend in SD's share price on just foreign institutions and more importantly, local government investment institutions. However, following the euphoria, SD's price could be repriced at a discount to pure plantations valuations. The discount could come to 20%. The discount is largely due to the fact that SD has its fingers in many pies as well - motor, oil & gas, utilities, heavy equipment and property. That's a conglomerate in my books.

No doubt that SD has a few factors going for it:

a) world's largest plantation group with over 500,000ha - that has to mean something

b) more than 75% of its palm oil are young (below 15 years)

c) seemingly stronger & more professional management

d) finally a Malaysian counter that can provide ample liquidity to "big investors" - over 6bn shares in share capital and a decent free float

e) a premium rating should be accorded for the above factors cited

The often cited synergies and cost savings in plantations still needed to be delivered. Valuation wise, the simplest would be a sum-of-the-parts valuation based on the business PER for the respective businesses. After scouring some of the latest research reports, on the low side we have Kim Eng/Yuanta with a RM9.60 valuation and an exuberant OSK target price of RM13.65.

At the end of it all, we have to ask ourselves if Synergy Drive is indeed a better animal than Sime Darby. Well, plantations make up 21% of Sime Darby's operating profit in FY07 compared to 45% for Synergy Drive. Heavy equipment made up 44% of Sime Darby's operating profit in FY07 but only contributes 18% to Synergy Drive. Going forward, palm oil and other soft commodities have a much better outlook on a 3-5 year view.

For foreign funds, palm oil is increasingly being seen as the only unique and worthwhile exposure worth looking at when investing in Malaysia - that's something a lot of people don't want to hear. If you are touting banks, airlines or utilities: to a regional investor he/she have the option of investing in similar industries in HK, Japan or Singapore - where the stocks may be bigger and more liquid.

All big Malaysian companies must compare themselves to regional or even global peers in their industry in order to be noticed. Getting bigger like SD is one thing, performing like IOI Corp is another.

If you are a fund manager, god help you if you do not have some Synergy Drive in your books at a decent price. For retail investors, don't chase, just wait a week or two, there should be at least one or two new covered warrants on Synergy Drive, that's a better trade.

Monday, November 26, 2007

Rio Tinto & Implications

I had expected China to join in the battle for Rio Tinto following BHP Billiton's bid a couple of weeks back. Now that Rio Tinto has rejected a merger proposal from its largest rival, BHP Billiton, which valued Rio at about US$142 billion (HK$1.10 trillion), this creates an opening for China. BHP Billiton, Rio Tinto and Brazil's Cia Vale do Rio Doce are the three biggest mining companies in the world. Together they account for 70% of the globe's total iron ore output.

The potential merger of BHP and Rio Tinto aroused concerns among China's steelmakers and the central government as China is the world's top steel consumer. China Development Bank has secretly bought about 1% in Rio Tinto during the week that BHP Billiton offered the hostile bid. Despite no confirmation, the move was seen as a move by China to ensure there will be no combined entity dictating iron ore pricing.

China's newly set up sovereign wealth fund, China Investment Co, will join the bidding for the world's second-largest mining group, Rio Tinto, together with Boasteel, Shougang and Angang. China's collective bid could be around US$200bn. Well, thanks to BHP Billiton, they have now stirred a hornet's nest. US$200bn will see China bidding 40% higher than BHP's offer. Plus, BHP's offer was an all share offer, that should be easily topped by China.Why the fervour to snap up Rio Tinto? Well, China already takes half of all iron ore from BHP. As mentioned before, the top 3 producers control 70% of the global iron ore production. A tie up between BHP & Rio would strengthen the producers pricing power and put China at their mercy.

BHP would probably back off as investors have been hammering BHP's share price following the audacious bid. Following the bid for Rio Tinto, BHP Billiton's share has seen some US$32bn being erased from its market cap.

BHP's bid is not so much to control prices but for the company to post strong earnings growth. The relatively new CEO of BHP, Marius Kloppers probably sees the bid as the easiest way to grow considering the size of BHP. Return on assets at BHP has averaged 35% during the past five years, compared with 32% for Rio Tinto. BHP's five-year growth in earnings before interest, tax, depreciation and amortization also outstrips Rio's, 29% to 26%. What is likely to happen is BHP backing down, and the Chinese steel companies gradually accumulating strategic stakes in Rio Tinto and Brazil's Cia Vale in order to preempt something like this happening in the future. The Chinese don't really want to take over Rio Tinto at this point in time, its too sensitive and aggressive. Nothing to stop them from accumulating small strategic stakes though.

Posco, JFE and Chinese steelmakers attacked the BHP's bid proposal, saying it would be harmful to the iron-ore market. The Brussels-based International Iron & Steel Institute, which represents ArcelorMittal and 18 others among the world's 20 largest steelmakers, urged regulators to block the bid.

Steelmakers in China are already facing an increase of as much as 50% in prices for iron ore over the last 6 months. Prices have tripled to US$72.11 a metric ton for Brazilian iron ore the past five years. About 1.6 tons of iron ore are needed to make a ton of steel. Hence it is pretty important to China that they "control" iron ore prices to some extent.

Sunday, November 25, 2007

Unbelievable Effort!!!

Badminton has a very special place among Malaysians. Considering our smallish population, its amazing that we do relatively well against the other nations. Due to our build, we can only succeed in games that are usually non-contact and those which favours a lower center of gravity and agility. Hence we are pretty awesome in squash, bowling, lawn bowling and badminton. Fergedabout football already!

Just a day ago, she sent world champion Zhu Lin packing in the quarter-finals. National coach Wong Tat Meng had only praises for his charge’s breakthrough performances. “I have been coaching her for three years. But now, I am proud to say that she has developed her own style of game. She has her own brand now. People use to call her a runner but today, she was attacking Zhang Ning and scoring points ... that was amazing,” said Tat Meng.

Thursday, November 22, 2007

In January 2006, CNOOC, China's largest offshore operator by output, bought a 45% interest in Nigeria's Akpo field for US$2.27 billion. The same month, it bought a 35% interest in the license to explore for oil in a Nigerian offshore block. China is on course to overtake the U.S. as the world's largest energy consumer soon after 2010, according to the International Energy Agency, but its domestic oil production is set to peak around the same time, leaving a supply gap that will have to be filled by foreign oil. As a result, Chinese oil companies are investing massively in Africa, searching for oil to fuel the country's booming economy.

Tuesday, November 20, 2007

Temasek is the largest single shareholder in London-based StanChart, which makes two- thirds of its profit in Asia. Temasek sources confirmed the approaches but insisted that the agency had rebuffed the advances. StanChart executives are unlikely to welcome a change in its largest shareholder to another lender, as this could trigger fears about its future independence.

The Money Train - Will They Or Won't They?

I know its a silly sounding translation from Cantonese, the "direct train" or "straight through train", both referring to the program that was supposed to allow Chinese citizens to invest directly in HK shares. Let's look at the debate, the highs-lows, and the probability in the end.

a) The plan was first announced on August 20th that a pilot program will be started to allow nationals with a Bank of China account in Tianjin to buy HK listed shares. Since that day, the HSI has appreciated some 45% to reach 32,000 but has given back quite a bit over the last two weeks.

b) HSI suffered selling bouts after a Credit Suisse report on Nov 12th said the pilot program had been delayed till 2Q 2008. The report also said that the government may impose a US$30bn cap for the entire program.

c) It is however, more likely that the sell down was due to sentiment being affected by the authorities' clampdown on the illegal money transfers from Shenzhen to buy HK shares (please read blog below).

At the end of the day, China still has too much liquidity despite the recent sell down in China stocks. They already have the QDII program which could see some US$70bn going overseas. The sovereign fund CIC will be investing some US$200bn overseas as well. The "direct train" program is expected to draw out US$30bn into HK. All up, we are looking at taking US$300bn away - if you hook that up with a few more mega A-share listings next year, that will certainly keep a cap on the upside for China equity markets next year, or at least make it a lot harder and volatile. It should be a lot tougher to make money in Shanghai and Shenzhen next year.

On the matter of overseas investments, the bulk of it will go straight for HK listed shares, followed by Singapore and then South Korea. Talking about A-share listings, the current market conditions may have postponed the A-share plans for CNOOC, the next best thing after Petrochina. But it should proceed once the market is on a better footing, look for Jan/Feb 2008 listing. Following that, Zijin should be next, an excellent gold play / commodities play. Also in the news, China Railway Group, the world's third largest construction contractor & the largest in China, will be raising US$5.5bn from its HK and Shanghai IPO for a simultaneous A-share and H-share listing.

So, in conclusion, will the "direct train" become a reality? Chances are very high that it should occur because soaking up liquidity and presenting investors with more alternatives are major priorities to Beijing. On Monday, the Shanghai Stock Exchange announced that it will allow foreign MNCs to list on their exchanges - more alternatives and to soak up liquidity. The 3 companies cited to get the ball rolling were HSBC, Coca-Cola Amatil and Siemens. The HSBC homecoming listing will be an event of major proportions, mark my words.

Monday, November 19, 2007

Merchandise exports grew 6.4% in real terms, with exports to Chinese mainland and many other emerging markets growing well. Services exports grew 12.3%, reflecting strong inbound tourism, vibrant financial market activities and a continued surge in offshore trade. Domestic demand played a key role in driving the economy forward. Private consumption spending grew 9.7%, supported by the improving job market and rising household income and wealth.

Saturday, November 17, 2007

A Disconnect In Equity Markets

Even my aunt has been selling her share holdings!!!

Of late there has been a disconnect in global equity markets. Its like all were at a party dancing and talking, and somebody switched off the electricity. Everyone is mumbling among themselves that they are having such a fine and dandy time, maybe they should continue dancing and partying in the dark and without air-conditioning. Some decided to leave for home and rest cause they know it will take some time before electricity is restored.Important Market Strategy Pointers

a) The only "safe" equity markets seem to be the US and Japan. Both for differing reasons. The US because of the devalued dollar, if the dollar decline over the last 4 weeks did not happen, the Dow Jones index probably will be trading at 11,000 now. The Nikkei is caught in a quandry with a stronger yen, but its probably the ONLY economy not having to deal with inflationary pressures - hence Japan is not in danger, in fact it may be the best performer for the remainder of 4Q2007.

b) The HK and China markets have been the most robust and active over the last 4 weeks. The huge Petrochina and Alibaba.com listings have propelled momentum driven investors. Following the euphoria, the Shanghai and Shenzhen markets are going into a downtime. The markets there failed to maintain above the 150 day trendline despite trying a few times. That took some liquidity players away from the markets. When markets experience a downshift in liquidity, people go looking for reason, and the CPI / inflationary pressures were convenint (and real) excuses. Investors were spooked when the same excuses were repeated day in day out. Those were excuses for the markets there to deflate. To me, the shift down in China markets is more a technical thing rather than a fundamental exorcism. They will need to find their feet before rebuilding, so no hurry to bottom fish in China markets as these momentum driven markets will need to build a bse first before relaunching themselves, it won't be a V-spike back up. Take your time to see the base building.

c) The HK market is probably the BEST long market globally for the next two quarters. The disconnect in the currency owing to its USD peg created a downward pressure on its domestic interest rates (being at a a much higher level than the prevailing rates in the US). The weaker USD automatically boosted competitiveness in HK, a sort of reverse "post Asian financial crisis". Following the 97 crisis, all Asian currencies lost between 30%-50% of their value against the USD. HK kept their peg, and hence huge structural unemployment was hitting HK the worst. Large chunk of industries which can no longer compete with the "expensive peg" were forced out. Many moved to Shenzhen if they could. Now, we are seeing the reverse - the pain before, now the pleasure.

The HK market is now the BEST long market because it is a natural China play, without the frothy valuations. The HK market is also the most liquid Asian place to be. International investors have been converging there almost the same time the USD started to weaken dramatically. Funds have been redirecting capital to HK at the expense of smaller Asian markets - thats very clear over the last few weeks.

d) Smaller Asian bourses will be ignored. Following from the above pointer, smaller Asian bourses will be ignored. Coupled with the fact that there is a global inflationary problem rearing its head now from Argentina to Malaysia to China and Australia. While HK lso has that problem, the interest rate & currency shifts still favour HK equities.

e) Of all Asian bourses, Malaysia seems to be hardest hit over the last 2 months. Though the ringgit is at 3.35-3.39 against the USD. The ringgit actually gained the LEAST against USD when compared to all Asian currencies, including the NZD, AUD, pound and Euro. So, basically after a stellar currency strengthening in 2H2006 and 1Q2007, since then the ringgit has been a huge underperformer. I mean, the ringgit also underperformed the Thai baht over the last 12 months. What gives?

The government and Bank Negara are not saying anything but its a clear reflection on the highish valuations above 1,400 level and a gradual exit of foreign funds to HK. Foreign funds had a good run on the ringgit and the KLCI, and above 1,400 seems a touch iffy going forward. Recent political developments did not help matters. More crucially, foreign investors are a bit fed up with Malaysia's brilliant "power point presentations" on the various "corridors and big concept plans ... and the stigma on subpar execution and lack of transparency. The Port Klang thing probably scared off many real Gulf states big investors. Why does it take so long to push things from concept to reality?? We all know the answers, get the professionals, reward performers, punish the insiders trying to take care of themselves. No follow up on offenders, troublesome issues left on its own with authorities hoping the media and public will eventually forget them, or cause them to focus on some other diversion.

Corporate wise, the DIGI-Time deal left a very sour taste in the bigger picture players. Yes, DIGI climbed but its due to the removal of the uncertainty and that Telenor is still in control. But its so obvious that a company with the track record and success of DIGI cannot get the GGGGGG license on its own, but will only get it after "bailing out" another wasteful and mismanaged company - guys, if we mismanaged less companies, we won't have to rely on these "ingenious" corporate manouveres - and we should have learnt that over the last 15 years..., yes/no???

f) Research houses citing the upcoming elections as a big kicker for the KLCI have a bigger chance to be wrong in light of the above factors cited. Just look at the wonderful active volume in PN17 companies and third rate companies dominating the volume charts over the last few weeks - ah, yes, these are the "election counters" ... really? If those are election counters, its a wonderful reflection on the real economy.

Thursday, November 15, 2007

The World According To Goldman Sachs

The stars are all aligned and the planets all converge to make Goldman Sachs and its alumni the most powerful "club" in the financial world. Merrill Lynch has just announced that it will appoint John Thain (the current head of NYSE Euronext) to be its CEO. Yes, Thain was a former mortgage bond trader at Goldman Sachs before rising to the top as president &COO of the esteemed firm.

Possibly the last piece of the puzzle will be whether Robert Rubin (ex-Goldman Sachs CEO as well) will be appointed to replace Chuck Prince at Citigroup. It looks likely and this "club of insiders" will almost control the global financial world. They already have Henry Paulson (another top alumni from GS, former chairman & CEO of GS) as the Treasury Secretary.

The thing is that is only the surface, Goldman Sachs' alumni is a headhunter's paradise for the very top financial and political jobs in the US and most of Europe. Here are a few examples:

a) GS will not be leaving its mark at NYSE Euronext following Thain's exit as Thain's successor will be Duncan Niederauer, an ex-MD & co-head of GS equities execution services.

b) The Treasury Undersecretary in the US for domestic finance is Robert Steel (former GS vice chairman). One of his important role is to direct bailout vehicle for banks with the huge Structured Investment Vehicles (SIVs), the cumbersome off balance sheet items of major banks and brokers.

c) One of the very top hedge funds manager globally, Edward Lampert (who currently is the chairman of Sears after having bought into the company) is from GS risk arbitrage unit.

d) Robert Kaplan, the current head of the highly influential Harvard Management Company, was an ex-vice chairman and head of GS investment banking unit. He replaces the highly successful but underpaid El-Erian. The endowment fund is around US$35bn.

e) The current governor of the Bank of Italy (central bank), Mario Draghi, is a an ex-MD at GS.

f) The current governor of Bank of Canada (central bank), Mark Carney, is also an alumni.

g) At the Federal Reserve Board, just a notch below Bernanke, sits William Dudley, another alumni, an ex-MD and ex-chief economist of GS. He oversees domestic open market in the US and forex trading operations and the provision of account services to foreign central banks.

h) The upcoming chairman of the Federal Reserve Board of New York will be Stephen Friedman, another GS alumni.

i) Robert Zoellick the new top guy at the World Bank was an ex-MD & chairman of Goldman's International Advisors unit.

p/s my bet for the next CEO for Citigroup will be the brilliant Jamie Dimon, the current CEO of JP Morgan Chase. He was the wonderboy under Sanford Weill at Citigroup but left Citigroup after losing a power struggle with Deryck Maughn in 1998. Jamie has since showed his mettle by building up Bank One speedily before merging it with JP Morgan Chase. Homecoming queen in the making. The position at Citigroup will be highly attractive to Jamie as it will prove he is "the man" in the end.

Wednesday, November 14, 2007

Tuesday, November 13, 2007

Monday, November 12, 2007

Friday, November 09, 2007

Shanghai Au Revior? Sayonara USD??

Following the listing of Petrochina-A share, the markets in China just continued to tumble. The People's Bank of China announced Thursday it might use a variety of measures, including bank and treasury bond issues and reserve requirement ratios, to control the country's "severe" liquidity problem.

A PBOC report gave no details about the extent of the measures or when or how they would be implemented, but it stressed that absorbing liquidity in banks and strengthening credit control could not fundamentally tackle the constant and rapid accumulation of liquidity and other structural problems. Recent talks about stock market risks by senior economists have also intensified worries about further government measures. China's economic growth is expected to exceed 11 percent for 2007 and growth in the consumer price index (CPI), the main measure for inflation, will be around 4.5 percent year-on-year, though some foreign analysts put the inflation figure to be at 6.0% at least. The latest figures and report by PBOC hints at at least one or maybe two more rate hikes before the year is over. Hence the rate hikes will definitely occur, and that is what's spooking China markets. The effort to maintain the dollar-renminbi exchange rate at a level approved by China’s State Council has already led to an enormous increase in the Chinese economy’s financial liquidity. The consequences of this are now manifested in property and stock market inflation, but not yet in rampant and uncontrolled consumer price inflation – at least for now. But if China does not accelerate the renminbi’s revaluation, the world might see a large burst of consumer inflation in China in the next 12 months. If so, the consequences will be a choice between the destructive runaway inflation and stagflation. The fall-out from this scenario, however, would be largely confined to Asia.

That being the case, the Shanghai and Shenzhen markets will find little incentive to buck the trend. Why bid prices higher when you higher prices will mean pushing PBOC to raise rates even more aggressively or worse, come up with penalising fiscal measures. Hence the China indices is in for a welcome breather. In actual fact, PBOC is not so concerned over higher stock prices as long as its a managed run up. They are more concerned over things like inflation and renminbi. It looks very likely that the yuan will be allowed to rise significantly over the next 2 weeks, it has to happen already - looking at how the USD is weakening, and how the Euro is headed for 1.5 against the USD, and the likelihood of the AUD reaching parity with the USD. Controlling inflationary pressures is utmost in the priority of PBOC, no two ways about it. Raising rates are not having the desired effect (they have done that 5x already this year).

As for the USD, we are seeing a realignment ala 1987, though in a more controlled manner. The Fed seems to be in agreement to have a weaker USD. Bernanke commented on the upside risks to inflation but focused more on the downside risks to growth. The Fed Chairman expects growth to slow noticeably in the fourth quarter, which confirms his dovishness. If he had done the opposite and focused more on inflation like his counterparts in the Eurozone and

Hence the China markets will be forced to find its feet first and consolidate, and we will have to see how much more will the USD be "allowed" to go weaker (I suspect another 5%).

More Upside For IJM Plantations?

Even at RM3.50, there should be more upside for the stock. Those who followed at RM3.00 will do well to hold till then or near that level. Just to recap the reasons for the rerating:

a) the company did not sell forward the bulk of their current production, unlike many companies

b) Hap Seng Plantations listing on November 16 should see the share trade at RM3.40-3.50, and all things being equal, IJM Plantations should trade at a premium to Hap Seng Plantations (please re-read previous post on both companies)

c) the expansion into Kalimantan is proceeding better than expected

d) a narrowing of discount from over 30% to maybe 20% as IJM Plantations is getting bigger and better managed (better yields comparatively to the average in the industry)

e) expansion plans aggressive and well managed, has acquired 3 parcels in East Kalimantan (11,000ha, 10,200ha and 11,000ha)

f) the managed landbank expansion puts IJM plantations from being a smallish player to mid-size and well on the way to narrowing the gap to the big boys - the planned expansion will see a CAGR of at least 6% over the next 5 years

g) hence, just like Petrochina-A listing, good to hold till Hap Seng Plantations listing as IJM Plantations is superior in almost every way even though both trade on the same EPS for 2007 and 2008

Wednesday, November 07, 2007

I Know What You Did Last Summer

Being in finance and investments, you have to keep learning new jargon. Six months ago many probably don't even know what CDOs were, many kept hearing it over the last 2 months and had a vague idea of what that is, but probably would find it hard to remember the actual definition in totality - man, where's our c-drive, no retention power, somebody defrag me... or just close all windows in my house and reboot!

Just when you thought it was safe to no longer mention "subprime"... hey all suddenly screamed "I know what you bloody banks did last summer!!!" You got me on HSBC, then Bear Stearns, the UBS joined the fray, jumped across to Northern Rock, now Merrill Lynch and the bigdawg Citigroup.

As I have said recently, the big banks waited for Paulson/Fed to come up with a US$100bn Superfund to help bail them out. That did not arrive, hence the revelation (just as scary as the one in the Good Book). Let's look at why so many investors are caught unawares on these shitty stuff. HSBC did the right thing, first to acknowledge that there is a problem, admit & write down the assets and control the exposure - that's why HSBC always trade at a premium in the eyes of Asian investors. The rest dragged their feet and evaded until it the cows actually rang the doorbell.

Many banks created Structured Investment Vehicles to carry a lot of these CDOs, and they did not show up on the balance sheets. Citigroup had the biggest OBS (off balance sheet) assets at US$222bn and their biggest SIV exposure was US$80bn, hence it would not be too far off to estimate that Citigroup may have to write off 50% of that in total or US$40bn. Bank of America staffers are probably the happiest as their banks have ZERO in SIVs and the OBS assets amount o only US$97bn. JP Morgan has US$128bn in OBS and has an exposure of over US$40bn to private equity firms. In total, Citigroup may have to write down US$21bn. That compares with potential losses of US$5.4 billion for Bank of America, the second-biggest U.S. bank, and US$4.1 billion for JPMorgan Chase. I think Bank of America is quietly sniggering that this debacle will close the gap between #1 and #2.

Merrill Lynch last month reported US$8.4 billion of writedowns in the third quarter and may be on the hook for another US$9.4 billion. However, the potential losses related to CDOs at the three major banks in absolute terms dwarf those of the largest brokers. Lehman Brothers, Bear Stearns, Goldman Sachs and Morgan Stanley, all stand to lose as much as a quarter of their equity. The announcement of Citigroup's potential losses and the exit of its CEO prompted Fitch Ratings to cut its rating to AA, three levels below the top, and say it may reduce the rating again. Standard & Poor's said it may lower its AA grade.

As bad as it sounds, the bad news seem to be a sigh of relief for the markets as more of the actual risks are now known. When you do not know the numbers, you worry more, now that you do - you can start to work off those numbers accordingly.