MEMs Tech vs Moolah

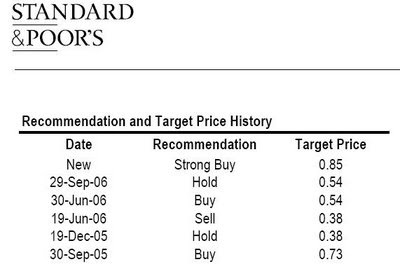

Well, my mate Moolah has done it again, I shall give him a new nickname, Dragon Slayer... but wait, those companies were no dragons at all, maybe Cicak Slayer ... nah, just Slayer will do. Just as effective and scary as Sylar if you ask me. Moolah tore Megan Media to shreds before it decided to implode on its own. As for Mems Tech, well, same old, same old... one person can be better than 3 research analysts at CIMB, OSK and S&P (of all places). Check out his posts (with apologies to Moolah), but first, Moolah noted the wonderful short history of S&P's recommendations for Mems Tech (loved the BUY at 73 sen, then a SELL at 38 sen followed by the STRONG BUY at 85 sen, all within a year - talk about being contrarian). Their earlier instinct was right, should have stuck to the SELL at 38 sen, then be a hero like Moola now already... or just reversing every single recommendation would have yielded the same results.

2 comments:

Not even the analysts who cover the stock can detect the business tricks.

The market need to have access to information as to who had made all this bad calls. Without it, one month later, some innocent may get trapped again.

Guess to save face, no one dare to publish the list of research analysts who had covered from Transmile to MEMS, except for Dali. But it is still not comprehensive as to who are the rest of analysts.

If we know them well, then this should not at all happen again.

Perhaps, Dali can present the "BEST from bottom" award at the year end. I am not trying to shot them down, but to make them awake as to not to buy all the stories from the Management over the briefings and a good lunch after that.

Hi Dali,

Thank you for such an educational blog -- the information is always well laid out and and your logic is very well explained.

I was wondering what are your thoughts about Evergreen, Sapcres, Sapcres-wa and UEMWorld? You've recommended those stocks in the past. Do you think the factors affecting the attractiveness of those counters have changed?

You mentioned before that we were in a 4 stage bull run. Do you think we are coming to an end? Would now be the time to start accumulating, or start disposing if the risks in trading have increased?

Would very much appreciate your thoughts on the matter. Thanks for reading this.

Post a Comment