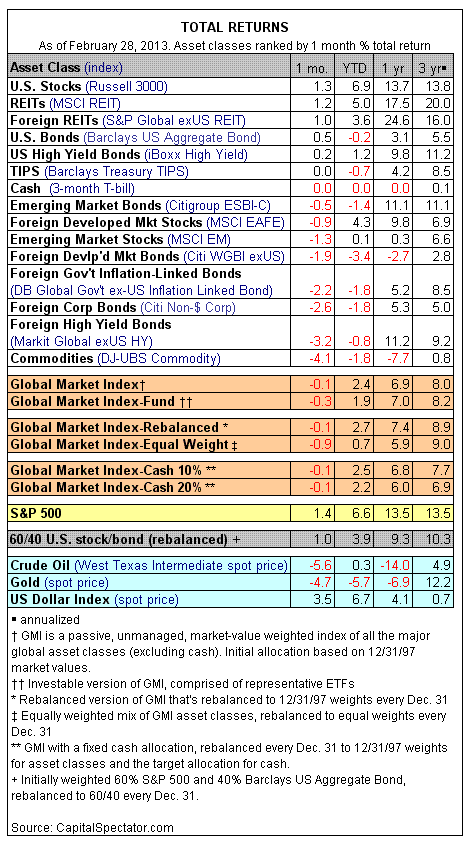

The big loser last month was commodities, which shed more than 4% overall. Meanwhile, REITs continue to rise, adding 1.2% in the U.S. market and gaining 1.0% on an offshore basis. Over the past year, REITs generally are in the performance lead among the major asset classes. Foreign REITs in particular are higher by a strong 24.6% through the end of February 2013. REITs has been on a tear for most of the past 12 months, a strong indication of the recovery in commercial properties - the fact that money is leaving the sidelines and venturing into stocks and properties in the US is a strong trend for a buoyant market in 2013.

By comparison, bonds, US and foreign have been muted, again a show of money exiting bonds. You would think that considering a market rally in equities based on liquidity (thanks to all central banks printing press) would have seen an effect in commodities, the reverse is happening. That is not a good thing as it may mean that the current equity rally is largely a bubble as it is not translating into real activity (i.e. pickup in commodities buying for end products or consumption). A better explanation would that there has been so much excess capacity and inventory for commodities that they will only pick up by June July methinks, same for the precious oil.

1 comment:

I have to agree that a bubble is building up in the equity markets and ready to pop.Last Friday the Dow came to within 15 pts of its all time highs.But the S&P was still 40(320 dow pts) over pts from its all time highs.Worst stii was the Nasdaq which was 1,500 pts away from its all time high set decades ago.

If my memory is correct,Dow transport made record highs months ago.And the DJ's is struggling as if 15 pts is a bridge from Putra Jaya to nowhere.That is the reason we went short the markets Friday afternoon.Could this be a double top.If it is going by conventional methods,it will be negative by a thousand odd pts.Giggles and laughter at the background.

The train overloaded with bulls is three quarters way uphill.With the bulls chasing after and jumping on the late night express,heavy on the tailend,it will be no surprise if the train flipped over 90 degrees and come tumbling down early next week.My gut feeling tells me a couple hundred pts upside for the Dow is max,if it ever gets there.

The fed's big boy Helicopter Benny has steered the federal reserve into a corner.All the printing presses of the fed and its counterparts running overtime has gotten the world's economy to nowhere.

The big boys have been enjoying the spoils of the central bankers.One day they might wake up and decide to make a u-turn.That going against the central banks is the easiest way to make money.If the markets forced the hands of the Federal Reserve,prematurely just to just raise 25 basis pts interest rates,Big Ben will be squatting by the roadside crying like a baby with only his boxers on.

That is the reason Big Ben last week before congress reassured the markets that interest rates will stay low till 2016.And he earned the nickname 'biggest dove around" from one of the congressman.For every 15-25 basis pts increase in bond yields,means half to a dozen free scorpenes for the Malaysian navy.That is the fix the feds and the world's central banks are in.They have painted themselves into a corner.

Last couple of weeks we have been active doing short term trades shorting the majors,and doing quite good.We went flat by Friday afternoon.Before the close we went short the loonie again,after it has recovered almoat 70 pips form its Friday lows.The loonie is on a long term bear market,and we will add more positions on a bigger correction.

The Euro and Swiss Franc has hit major support at the 200 days MA.There has to be at least a bounce if not a reversal.A daily close below the 200 day MA and it will be on its way to the cleaners.Maybe sometime next week or two.

By the way the USD/CAD is way above the 20,50,100 and 200 day MA.If this is not the start of a bull market,what is.The greenback is in line to be on a bullrun the next few years,against most of all the majors.

Post a Comment