Tuesday, January 29, 2019

RM22.5B Property Sale - Implications

Let's see how fast can the research analysts and fund managers react. RM22.5b property sale is nothing to snigger at. It is anticipated that there will be 180 property developers participating.

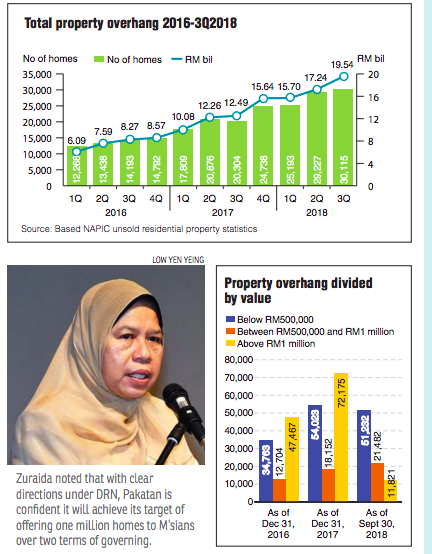

Of course, we are not going to clear the bulk of it. We are talking of over 30,000 properties. Each buyer will be another "potential buyer" off the market for normal property launches.

We can expect hefty discounts and even at bargain prices. There are 180 developers, how will you stand out. There are only so many buyers. One buyer for another property is buyer lost to the developers. Developers have been asked to offer at least a 10% discount. I can foresee even some will sell at a slight loss just so to improve their capital management and cash flow.

There will be repercussions and implications. How will banks and finance companies view the lending part? Will they be expected to "loosen their lending guidelines"? What about Bank Negara, which has been making it tough (necessarily) to get housing loans? These are pertinent questions which will need to be addressed openly prior to the March event.

- Any loosening of lending guidelines by the banks will result in a downgrade for all banks, owing to the deteriorating loan book. Hence we need more clarity for the government.

- A more realistic impact will be on property developers. The event will suck potential property buyers from the normal market. Watch the resale market prices, go ask your real estate agents, prices will come down by 10-20% minimum just based on the news, in particular for motivated sellers.

- Smaller property developers might as well close shop for a while unless you are very niche and has enormous value add to your products.

- Bigger property developers with townships will see a much longer period for the township to be developed. Not good for them, but this is a necessary evil owing to over-building and mismatching of needs by developers in the first place.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment