Performers in 2020 - Look at the gainers for 2020 for local stocks in the 3 pics. We have about 1,000 stocks listed and where less than 500 trade regularly. Hence to look for the gainers out of 500 stocks was easy, when the ecosystem is right.

Bursa came out with some nice data and charts on foreign funds in Malaysian stocks. Realistically, stocks are usually not considered in an Asian portfolio. Most wouldn't even be bothered to have exposure to it as it is so insignificant compared to the rest. China, Japan, HK and India collectively would dwarf the rest. In a South East Asia centric fund yes, but these are far and few in between. Asia-Pacific funds are more popular, even so you do not want to spend so much time on too many countries.A fund manager given a USD300m Asia Pacific fund can only look at so many countries closely, imagine if you have to keep track of more than 5 economies, and then drill down to at least 10 per country. The resources needed do not justify the fund size. Usually they will just buy the index as an exposure.

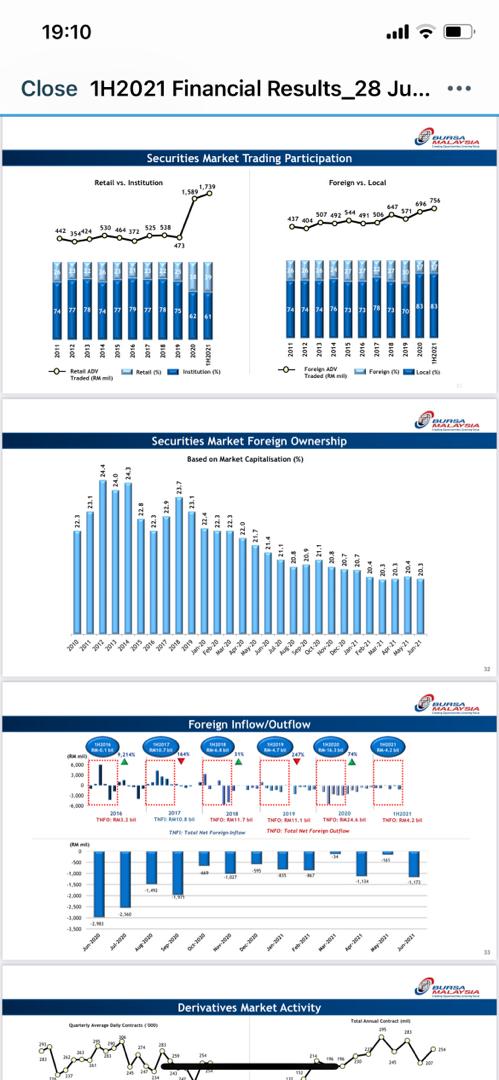

Looking at the second graph, the white portion showed the diminishing participation of foreign funds. Even more so with the onset of the pandemic. What that means is we can 'almost' forget about them. Their participation is neither impactful or "important". If you had to rely on them for fund raising, then we should be circumspect, we don't. But when we do, nowadays, like AirAsia, we will have to go to SG, Thailand, HK and maybe China to drum up funds. Not a frequent enough requirement to place too much emphasis on foreign funds participation in the market.

When we went through the Asian Financial crisis, where locally everyone have little ability to recapitalise, and when almost all the top 40 stocks have to raise funds to restructure - then we have to "beg" for foreign funds to participate.

The third graph showed the unusually steady rate of foreign holdings of local stocks. It would be fair to infer that a substantially large portion of that is satisfied by the need to index the country for exposure.

What you can see from the first graph was the rise and rise of retail investors. The last 12-18 months have been more than incredible to see the massive backlog of new retail account applications. For more than 15 years, Bursa has been worrying about the dramatic decline in retail investors in the country. So much so, many thought the trend was irreversible. Oh, how wrong most of us were.

Is it a trend or fad? I thinks a lot more than that. The rise of penny stocks, coupled with the sustained jump in interest in glove stocks, somehow were the needed catalysts. It coincided with the pandemic which causes lower employment and less "business activity" (side incomes) for all.

Is it a trend or fad? I thinks a lot more than that. The rise of penny stocks, coupled with the sustained jump in interest in glove stocks, somehow were the needed catalysts. It coincided with the pandemic which causes lower employment and less "business activity" (side incomes) for all.

This trend was reflected in most developed countries. The Robin-hooding and GameStoppers effects cause a significant wave and rise in younger investors. The culmination of Bitcoins (and others) gaining wider acceptance captured more younger investors, who then parlayed their gains into equity. Naturally the over-riding conduit that made all these events possible was the Internet.

Collectively, the new younger investors, together the rest of the investors in Malaysian stocks, have shown that we can generate incredible volume and volatility in stocks locally. That is going to lend a lot of comfort to big day traders, syndicates, local funds and listed/unlisted company owners - in that they can raise funds, participate in share price growth, way ample liquidity - provided the timing is suitable.