Its been a long time since I have featured a local listed company. CTOS has begun to fill up the gaps that I needed to see that should elevate its earnings platform significantly in the future. I wouldn't bat an eyelid on the tax free status issue as its a temporary thing. THE MOAT (the barriers to entry)

- In Malaysia it is already the main supplier of credit information. It has around 71% of market share locally.

THE OPPORTUNITIES (Regional)

- Not many realise that the consumer credit information platforms are still disjointed and haphazard in Thailand and Indonesia. A stock is only good for the population size it serves. Malaysia is a small market no matter how you look at it. CTOS has moved quickly to build on that in Indonesia and in particular Thailand.

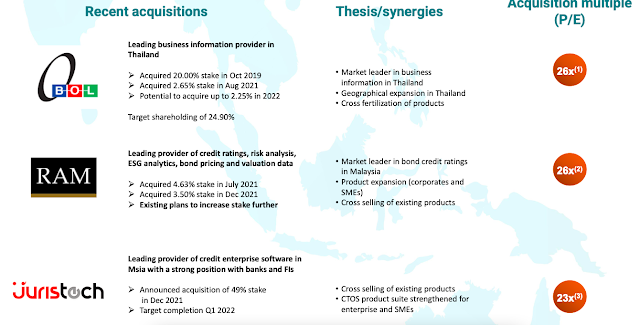

- 49% equity stake in Juris Technology Group for RM205.8m cash. Juris Technology is a leading Malaysian-based fintech player specialising in software solutions for financial institutions. It has a strong entrenched market position in Malaysia and overseas presence in 4 countries, namely Singapore, Brunei, Australia and UAE. Its client portfolio consists of more than 50 reputable corporations and 3,000 agencies consisting of leading financial institutions, banks, development funds and multi-national corporations. Juris’ business is also highly cash-generative in nature – with approximately 65% of its total revenue stream being recurring.

- The acquisition of a smallish 2.18% in Business Online (BOL) in Thailand for RM26.2m should be the first step for future corporate exercises in the future. As things stood, CTOS' stake in BOL has now increased from 22.65% to 24.825%.

THE OPPORTUNITIES (Expansion of natural demand)

- The paradigm shift in normal banking must be taken into account. Now websites are offering various types of consumer loans on their own (extended repayments of purchases, and micro loans).

- The rise and rise of Digital Banking. In Malaysia the new digital banking license will usher in a new wave of demand for credit information, as competition will shoot up for new products and tokenisation.

- Bank Negara Malaysia (BNM) is looking to roll out five digital banking licenses in 1QCY22 to hasten the penetration of innovative banking technology and boost financial inclusion by targeting the underserved and unserved banking population. SMEs contribute to about 50% of Malaysia’s GDP, would be one of the largest beneficiaries of digital banking. Digital banks are also expected to be more borrower-centric with more tailored customer solutions, faster approvals and disbursement of funds, simplified lending management and competitive rates. This would also ultimately benefit CTOS from two perspectives: (i) greater penetration into the local credit reporting market with more credit reporting assessments required for lending to the underserved and unserved banking population; and (ii) increased volume with faster approvals and disbursement of funds from digital banks.

- There is a likelihood that the 5 new digital banks could boost CTOS bottom line by as much as RM15m-20m a year.

It has 2.3bn shares. I expect CTOS to improve from a net profit a quarter from RM11.7m a quarter to an average of RM13m for next 4 quarters and RM16m for the following 4 quarters. Before you know it CTOS should be making over RM20m net a quarter. No point looking at PER now. Just buy and keep.

There's never a great low price to buy a really good stock. Just buy and keep averaging up/down over 3-5 years. The two charts below should provide comfort for long term shareholders.