I hate it when people give tips or stocks' potential based on "insiders' information". How is that a fair situation? What about the rest of investors who do diligent research and still get knocked about by these "insider informants". Can you still be a good investor based on publicly available information? We can only try.

THE SELLDOWN

Prestariang has had a very dramatic last 6 months. It could easily fill a business book by Michael Lewis... and that's just based on public information. If Michael Lewis gets to interview a few of the deemed players, it should be a great best seller.

SKIN was the project which was awarded on 18 July 2017, and the stock was around RM2.00 around that time. Now it's about 16% of that level. The project is a 15-year concession and will consist of three years of build and deployment phase and 12 years of maintenance and technical operation phase.

Payment to Prestariang was to only commence upon the full commissioning of the system after three years with an average annual payment of RM294.7 million from year four to year 15 during the maintenance and technical operation phase.

The big selling seems to have coincided with the resignation of Puan Nik Amlizan Binti Mohamed as an non-executive director on 1 October 2018. Interestingly, since then she had also resigned as a chief investment officer of KWAP too.

But the sharp sell down by KWAP was exacerbated withAIA selling its 9.73% stake which is around 46,968,900 shares in within weeks.

Those two events caused CEO Dr Abu Hasan Ismail to be faced with forced selling due to margin call. Prestariang founder and group CEO Dr Abu Hasan Ismail, who is also the company’s largest shareholder, saw forced selling of 15.1 million of his shares (late Nov/early Dec 2018)— representing a 3.13% stake held via his privately owned companies — to rectify a personal margin account position. Abu Hasan now holds a 24.3% stake in the company.

Prestariang’s other substantial shareholders are Kumpulan Wang Persaraan (Diperbadankan) (KWAP) with an 8.6% stake and Brahmal Vasudevan — who is the founder and CEO of private equity firm Creador — with a 6.2% stake. Over the past couple of months KWAP has been rapidly reducing its stake, and from the filings, it looks like Brahmal has fully exited his position over the last two weeks.

THE FUNDAMENTALS

So the base scenario is to strip out SKIN to see what's left for Prestariang. Assuming a weighted average cost of capital (WACC) of 6%, CIMB estimates SKIN’s value to be around RM750 million and since Prestariang owns 70% of it, the concession is worth RM525 million or RM1.08 per share to the company. PublicInvest Research has a similar valuation of the project. In a Sept 5 note, it says Prestariang’s stake in SKIN is worth RM521.3 million or RM1.08 per share, assuming a WACC of 7.48% and internal rate of return of 17%.

Hence even if you took the RM2.00 share price, much more than the "valued" RM1.08 has been eradicated from the share price. The excess losses may be attributed to previous "over-exuberance" and/or loss of favor with the ruling government. Even so, the "loss in share price is already deemed as probably excessive". A local research house has estimated that Prestariang’s book value could drop to 26 sen per share from 32 sen if earnings from the SKIN project are reversed.

Prestariang's financial results, with or without the first few inclusions of SKIN earnings, were decent. Not spectacular but decent. It is in no danger of falling into PN17 or anything like a big hole.

Apart from SKIN, Prestariang’s other dealings with the government include its contract to supply Microsoft software licences, products and services. In January this year, its subsidiary, Prestariang Systems Sdn Bhd, received an extension of its contract to supply the licences to MoF under the Master Licensing Agreement 3.0.The extension is for three years, from Feb 1 this year to Jan 31, 2021, at an estimated value of RM222.6 million.

Read more at https://www.thestar.com.my/business/business-news/2018/12/12/prestariang-seeks-compensation-over-skin-termination/#j3maqxqwwdDrxGTQ.99

WHO WERE THE BUYERS

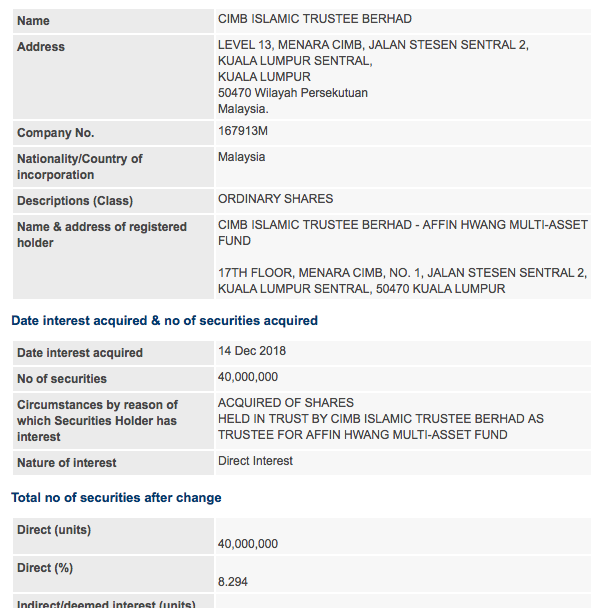

We have talked about the many substantial sellers over the last 4 months. Were all the shares bought by small time investors who do not know of the bigger picture? Well, there were two big buyers. It is up to you to research who they are.

One has 8.29% and the other ended up with 16%.

No comments:

Post a Comment